Retirement Education made easy

Understanding Teacher's Pension Annuity Fund / Public Employee Retirement System (TPAF / PERS) can be difficult so we broke it down here to make things simpler! Learn about the Tiers, How your pension is calculated, and what options you’re going to be making come retirement time.

Understand your Tier

- Members who were enrolled prior to July 1, 2007

- The attained age for Tier 1 is 60 years of age

- Early Retirement without a penalty is 55 Years of Age with at least 25 Years of Service

- Formula:

- Final Average Salary for Tier 1 is Equivalent to your 3 Highest Consecutive Years of Service

- Members who were eligible to enroll on or after July 1, 2007 and prior to November 2, 2008

- The attained age for Tier 2 is 60 Years of Age

- Early Retirement Option who retire before age 60, the allowance is reduced 1% per year under age 60 - 55, anything under 55 is 3% per year (Must have 25 Years of Service)

- Formula:

- Final Average Salary for Tier 1 is Equivalent to your 3 Highest Consecutive Years of Service

- Members eligible to enroll on or after November 2, 2008 and on or before May 21, 2010

- The attained age for Tier 3 is 62 Years of Age

- Early Retirement Option who retire before age 62, the allowance is reduced 1% per year under age 62 - 55, anything under 55 is 3% per year (Must have 25 Years of Service)

- Formula

- Final Average Salary for Tier 3 is Equivalent to your 3 Highest Consecutive Years of Service

- Members who were eligible to enroll after May 21, 2010 and prior to June 28, 2011

- The attained age for Tier 4 is 62 Years of Age

- Early Retirement Option who retire before age 62, the allowance is reduced 1% per year under age 62 - 55, anything under 55 is 3% per year (Must have 25 Years of Service)

- Formula:

- Final Average Salary for Tier 4 is Equivalent to your 5 Highest Consecutive Years

- Members who were eligible to enroll on or after June 28, 2011

- The attained age for Tier 5 is 65 Years of Age

- Early Retirement Option who retire before age 65 with at least 30 years of service credits, the allowance is reduced by 3% per year under age 65

- (Must have 25 Years of Service)

- Formula:

- Final Average Salary for Tier 1 is Equivalent to your 3 Highest Consecutive Years of Service

How is it Calculated?

How Do I Collect My Pension Benefit?

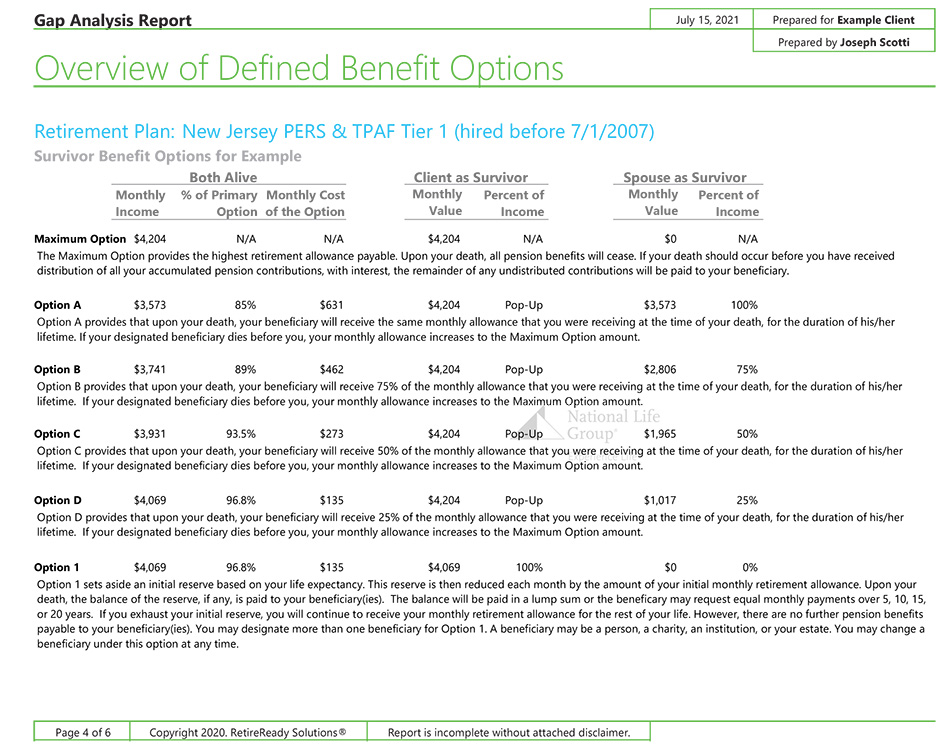

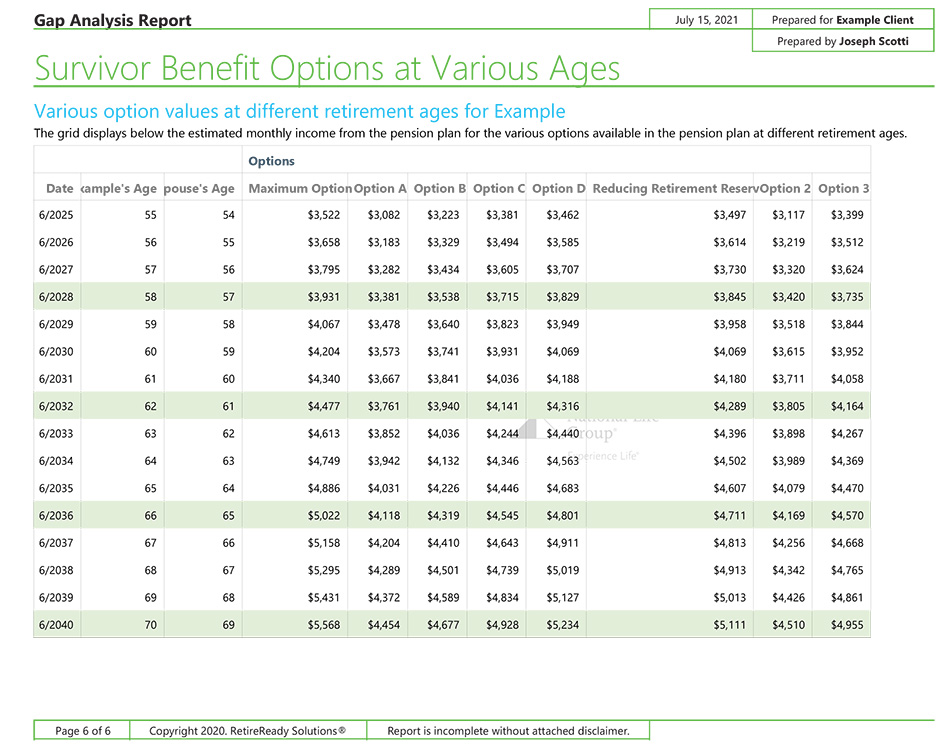

When it comes to the TPAF Pension, there are multiple options to choose from when choosing a Beneficiary Option. Maximum Option, Options A-D and Options 1-4. Each with a different definition of its own to define how your pension will pay you out, and how it will pay out to a beneficiary in the event of your passing. Each of these decisions are made at the time of retirement, the more thoroughly you understand your pension options, the more prepared you will be in making this decision.

Below is an example of a Pension Report that will give you an idea of what your Pension will pay you out and how the beneficiary options work and cost come retirement time.

Click to Download the Gap Analysis Pension Report